DISCLAIMER: All information, content, and materials in this blog post are for general information purposes only. Consult with your tax professional to determine qualifying home improvements in order to claim the Energy Efficient Home Improvement Credit.

January marks the start of tax season, and for homeowners looking to claim tax credits on their investments in energy-efficient home improvements, there's good news.

The Energy Efficiency Home Improvement Credit, a federal program that provides tax breaks to individuals with qualifying improvements to their primary residences, offers a valuable incentive for homeowners to make environmentally conscious home upgrades and contribute to a more sustainable future. Also known as the Residential Energy Efficient Property Credit, or the "25C" credit, this program covers a wide variety of home improvements aimed at increasing energy efficiency and reducing carbon output.

Read on to learn more about this federal program and how you can take advantage of this beneficial energy tax break.

Contents:

- What is the energy efficiency home improvement credit?

- How much credit can I receive?

- How do I qualify?

- Qualified expenses and tax credit limits

- How do I claim this tax credit?

- Tips on maximizing your credit

- Claiming tax credits with reflective insulation

- FAQs

What is the energy efficiency home improvement credit?

The Energy Efficiency Home Improvement Credit is a federal tax program that provides homeowners with deductions on their annual taxes for installing energy-efficient improvements to their homes. Homeowners eligible for this tax break must submit an additional tax form (Form 5695) to the IRS in order to receive the credit. Once submitted and approved, the credit directly applies to your overall tax liability.

All qualified expenses must meet the criteria set by the IRS and includes any improvements to exterior doors, windows, and insulation, as well as upgrades to central air conditioners, water heaters, furnaces, heat pumps, and biomass stoves and boilers. Home energy audits also apply for this tax credit, as long as these audits were conducted by certified professionals (more on this below).

How much credit can I receive?

The Energy Efficiency Home Improvement Credit provides homeowners with credit that equals up to 30% of the total home energy improvement costs, or up to an annual dollar cap of $3,200. This dollar cap is divided into two groups: a $1,200 annual credit limit for building envelope components (e.g., exterior doors, windows, insulation), and a $2,000 annual credit limit for larger property installations (e.g., heat pumps, water heaters, furnaces, etc.).

In 2022, the Inflation Reduction Act brought on significant changes to the Energy Efficiency Home Improvement Credit that increased the amount of credit possible for eligible homeowners. This program also received a 10-year extension starting Jan. 1, 2023, allowing homeowners to claim up to the maximum credit amount of $3,200 each year until Jan. 1, 2033.

How do I qualify?

To be eligible, homeowners must meet certain criteria set by the IRS. First, applications for the Energy Efficient Home Improvement Credit can be accepted by anyone, from all tax brackets and filing statuses. Second, the energy-efficient improvements must be done to a home or other residential building that is considered a primary residence.

Homeowners can claim the tax credit for energy-efficient improvements if the residency is:

- the homeowner's primary home (where they live the majority of the year).

- located in the United States.

- an existing home that you improved or added onto.

In contrast, homeowners cannot claim the tax credit if the residency is:

- used as a rental property (i.e., a landlord improves energy-efficiency on a rental home).

- 100% used for business purposes, profit or non-profit.

- a vacation home, or non-primary residency.

- a newly built home.

What are the qualified expenses & tax credit amounts?

To receive the Energy Efficiency Home Improvement Credit, the type of improvements must meet specific standards. All home improvements must have new properties and components installed or in service within the specific year, and cannot be used prior to the installation or service date. Any of these items purchased but not installed do not qualify for the tax credit.

The home improvement properties and components can be split up into three categories:

- Building envelope components

- Residential energy properties

- Home energy audits

Each one contains specific requirements as well as tax credit dollar caps per item.

1. Building envelope components

A building envelope is the primary boundary between the indoor and outdoor space of a home. Materials that contribute to this separation are known as building envelope components. Certain components that contribute to energy-efficient standards meet criteria set by the IRS and qualify for the Energy Efficiency Home Improvement Credit.

Below shows the list of components eligible for the energy tax credit, along with the set credit limit per year:

Component/Service |

Available Tax Credit |

|

Exterior Doors |

$250/door; up to $500 total |

|

Exterior Windows and Skylights |

Up to $600 |

|

Insulation and Air Sealing |

30% of costs; up to $1,200 |

To qualify, all building envelope components must have an expected lifespan of at least 5 years. Additionally, these components need to meet applicable energy certification requirements set by both Energy Star® and the International Energy Conservation Code (IECC). These are spelled out below:

- exterior doors need to meet applicable Energy Star requirements;

- exterior windows and skylights need to meet Energy Star Most Efficient certification requirements; and

- insulation and air sealing systems need to meet IECC standards in effect at the start of the year 2 years before installation.

Insulation and air sealing installations do not have a maximum dollar cap besides meeting the maximum credit limit of $1,200 for all building envelope components.

2. Residential energy properties

Residential energy properties use some form of energy to regulate air and temperature conditions within a home. These properties include central air, furnaces, water heaters, boilers, heat pumps, and electrical panelboards. All residential energy properties must meet the Consortium for Energy Efficiency (CEE) highest efficiency tier to qualify for the Energy Efficiency Home Improvement Credit.

The table below provides all residential energy properties eligible for the tax credit, along with their set credit limit per year:

Component/Service |

Available Tax Credit |

|

Central air conditioners |

30% of costs; up to $600 per item |

|

Water heaters (natural gas, propane, oil) |

|

|

Furnaces |

|

|

Hot water boilers |

|

|

Panelboards, sub-panelboards, branch circuits, or feeders |

|

|

Heat pumps |

30% of costs; up to $2,000 |

|

Biomass stoves and boilers |

For electrical work, heat pumps, and biomass stoves and boilers, these properties need to meet additional requirements in order to qualify for the tax credit, including:

- all costs of electrical work necessary to support residential energy properties must meet the National Electric Code standards and have a capacity of 200 amps or more; and

- all heat pumps, biomass stoves, and biomass boilers need a thermal efficiency rating of 75% or higher.

Heat pumps and biomass stoves and boilers follow the same track as insulation, as they account for all residential energy property costs, including installation labor, with no per item dollar cap besides the total maximum cap of $2,000 for all residential energy property costs.

3. Home energy audits

Lastly, home energy audits qualify for the Energy Efficient Home Improvement Tax Credit. In order to qualify, a professional home energy auditor needs to conduct an inspection and provide a report identifying the most significant and cost-effective improvements, as well as estimated cost savings from these improvements.

Component/Service |

Available Tax Credit |

|

Home Energy Audit |

Up to $150 |

The Department of Energy included additional requirements starting in 2024, which include that:

- the inspector must be a certified home energy auditor at the time of the audit, or under the supervision of a qualified home energy auditor;

- the signed and prepared report must include:

- the qualified home energy auditor's name and EIN;

- attestation of certification from a qualified program; and

- the name of the qualified program.

How do I claim the energy efficient home improvement credit?

To claim the energy tax credit, you need to file Form 5695, Residential Energy Credits Part II, with your tax return in order to receive the Energy Efficient Home Improvement Credit. Keep in mind these important points in order to claim the credit:

- that all home improvements must be completed within a specific year to receive eligibility; and

- that the home improvements must be installed or in service within a designated primary residence, rather than merely purchased.

Homeowners cannot claim this tax credit if their component or properties haven't been installed. Make sure to provide itemized invoices and receipts for home improvements, including labor costs, completed within that year. Once filed, then the credit received applies to your overall tax liability.

Tips on maximizing your credit

As mentioned previously, the Energy Efficient Home Improvement Credit is designed to encourage homeowners to install energy-efficient components and properties to combat long-term energy costs and usage. With this tax credit, there are ways for homeowners to get the most out of their installations when filing their claims. Below are a few tips on maximizing your credit to save the most on your investments in home efficiency:

- Time out your installations: The $3,200 annual credit limit renews each tax year. Because credit is received based on installed improvements, rather than purchased, this allows homeowners to time out their expenditures and maximize the amount of credit they can receive in a year. This especially works for larger installations like HVAC work.

- File for Residential Clean Energy Credit: Another possible credit available to homeowners is the Residential Clean Energy Credit. This allows taxpayers to claim up to 30% of the costs of renewable, clean energy properties such as solar panels, wind turbines, geothermal heat pumps, battery storage technology, and more installed on their primary residence. Homeowners can file for this credit under the same Form 5695 Residential Energy Credits, under Part I.

- Pair with Energy-Efficiency Rebate Programs: Lastly, there are other rebates designed to reduce the costs of energy-efficient home improvements that can add to your overall savings this tax season. Be sure to check the IRS website to see how rebates work in tangent with the tax credit, as well as factor into your overall savings.

By being strategic and well-informed in your approach to energy-efficient home improvements, you can optimize the benefits of the Energy Efficiency Home Improvement Credit, not only in terms of tax savings but also in creating a more sustainable and energy-efficient home.

How to claim tax credits with EcoFoil reflective insulation

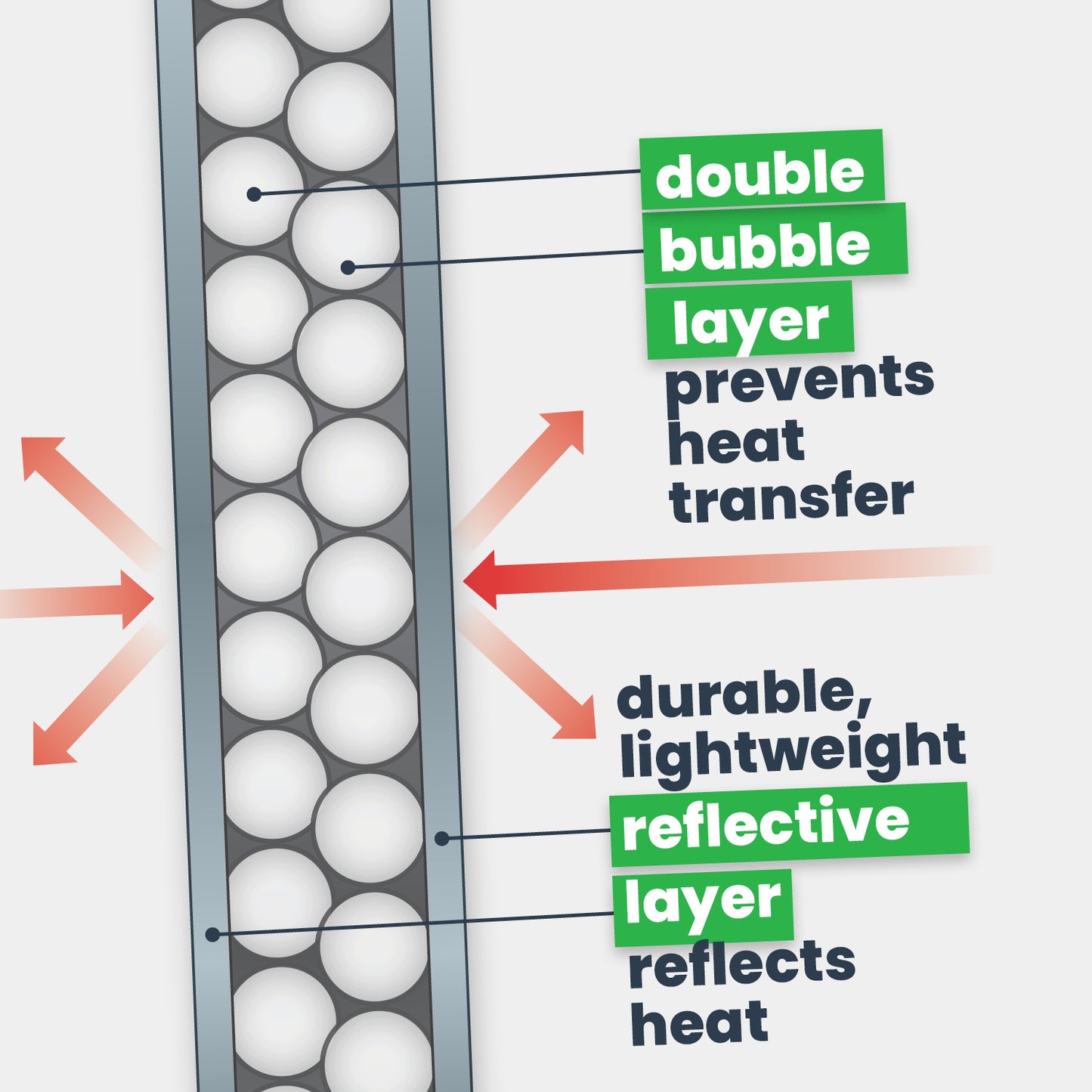

Reflective insulation products can technically qualify for the Energy Efficiency Home Improvement Credit. The program requires that any insulation added to a home needs to enhance the R-value of the overall insulation system up to the current IECC residential code. These R-value requirements vary depending on the climate zone you live in.

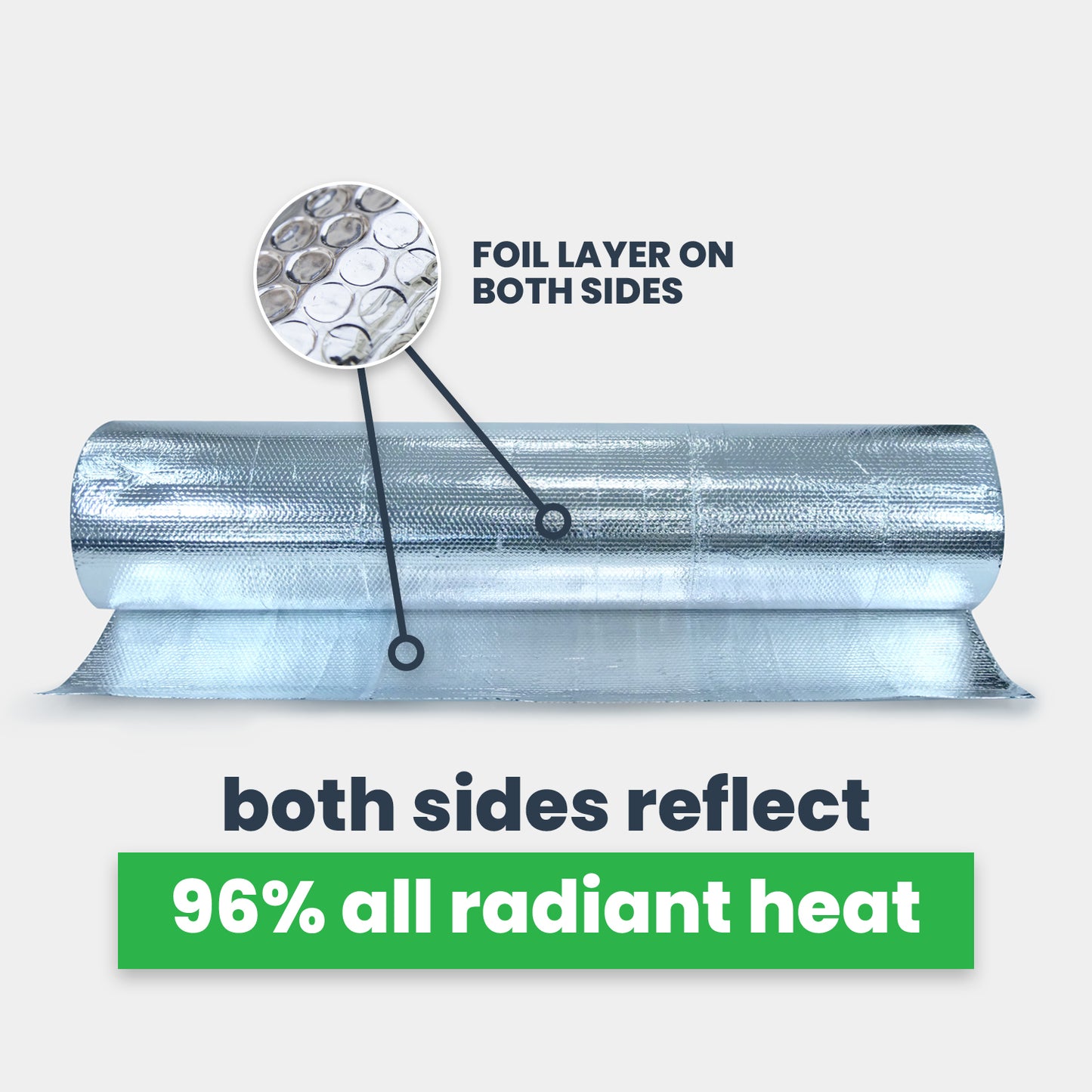

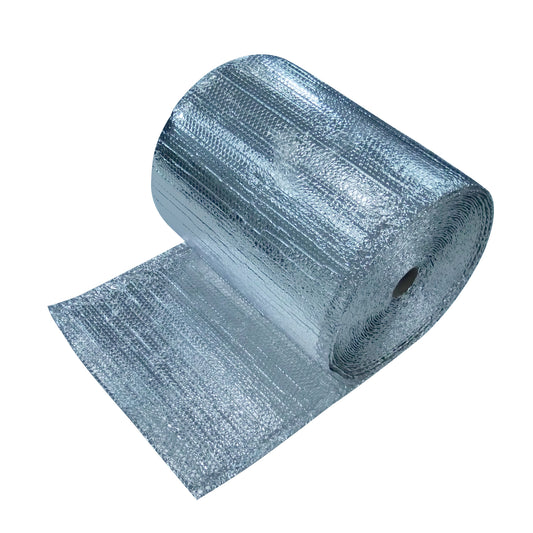

Because EcoFoil reflective insulation contributes to the overall performance of your insulation system by blocking up to 96% of radiant heat transfer, homeowners who've installed these products may qualify for the Energy Efficiency Home Improvement Tax Credit. These products include:

- Single Bubble Foil Insulation

- Double Bubble Foil Insulation

- Between Joist Insulation

- Under Slab Insulation

Radiant barrier foil insulation, while not explicitly mentioned as a qualifying insulation product, still enhances the efficiency of your home's insulation by reflecting up to 96% of radiant heat transfer. Talk with a tax professional to determine if you can claim tax credit on your home improvements involving radiant barrier.

Home Energy Tax Credit FAQs

Q: Can I qualify for the energy efficient home improvement credit if I use my home for business purposes?

A: That depends. If you use a property for 100% business purposes, then you cannot claim this credit. However, if you use the property partly for business, then tax credits are as follows:

- Full credit received for homes with business use up to 20%.

- Homes with business use over 20% can receive credit based on share of expenses for nonbusiness use.

Talk with a tax professional to learn more about claiming this tax credit on allocable nonbusiness use of your primary residence.

Q: Do I include installation labor costs when applying for the tax credit?

A: Taxpayers can include the installation labor costs for residential energy properties (e.g., central air, water heaters, furnaces, hot water boilers, heat pumps, biomass stoves and boilers) that likely require a specialist for installation.

However, labor costs for installing building envelope components, as well as home energy audits, do not qualify and should not be added into the overall cost of building envelope components.

Q: Am I able to carry forward unused credits to another tax year?

A: No. Since the Energy Efficient Home Improvement Credit is non-refundable, any excess or unused credit remains unclaimed for that year. The credit amount is only available for that specific year and cannot roll over into another year.

Q: Is there a lifetime limit on the Energy Efficient Home Improvement Credit?

A: No. A taxpayer can claim the maximum $3,200 credit allowance every year that eligible improvements are made. This is true for each year until Jan. 1, 2023.

You can find more information on the IRS website and their fact sheet.

More Articles You May Like:

Does Reflective Insulation Have R-Value?

5 Ways to Reduce Your Home Electric Bill

LEED and Green Building: What Are They?

Home Remodeling with Reflective Foil Insulation

For any questions or insulation advice, give us a call at (888) 349-6264, send us a chat, or email us, and our team of product experts will help!

EcoFoil is a supplier of radiant barrier and reflective insulation products, and does not, nor intend to, constitute tax or legal advice; instead, all information, content, and materials presented in the provided blog post are for general informational purposes only. The information in this blog post is provided by the U.S. Internal Revenue Service (IRS) and other third-party websites, and may not constitute the most up-to-date tax information regarding the Energy Efficiency Home Improvement Credit. Consult with a tax professional to determine the maximum credit limit allowed on qualifying home improvements.